Secret Takeaways Rideshare insurance coverage covers you when you drive your auto to make cash, whether it's a full time work or a part-time side hustle. If you have a rideshare gig without telling your insurer regarding it, they could possibly terminate your protection for not disclosing your vehicle's company use.

If you drive for a business like Uber or Lyft, they likely provide some quantity of protection that covers you a minimum of some of the time, so contact the company to discover what coverage they might or may not provide. Rideshare insurance coverage is developed to cover you when your individual protection and your rideshare business's insurance coverage don't, which is essential if you don't wish to be stuck paying for problems out-of-pocket in a crash - car.

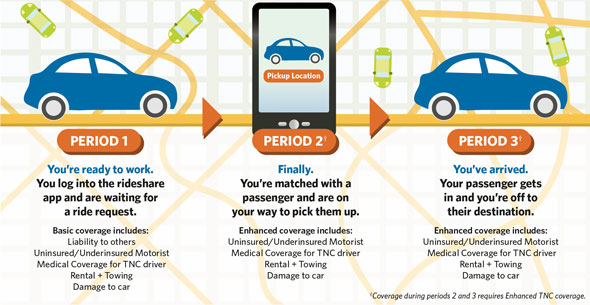

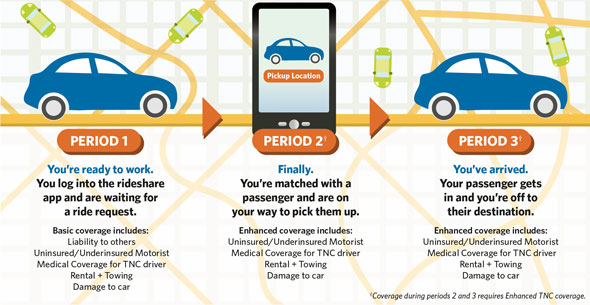

This normally includes going to the grocery store, taking your kids to school, and also various other things you do while you aren't working. Your personal auto insurance puts on any type of accident or various other concern that occurs throughout this time. Duration 1Your rideshare app is on, but you have not approved a flight. cheap car insurance.

If so, they can usually provide you a rideshare recommendation or motorcyclist, which means they add the coverage onto your current policy. If your current insurance policy firm doesn't use rideshare protection, get to out to an additional company or an insurance representative to obtain a quote on a car insurance plan that does offer a rider for rideshare coverage.

Check with your supplier to see what insurance coverage alternatives they have readily available for you. Insurance with your rideshare work, Several rideshare companies supply at the very least some insurance coverage for you as a motorist, but not every one of them provide insurance policy and some just offer partial insurance coverage. Grub, Center and Instacart don't use any kind of insurance coverage at all, while Door, Dash just offers obligation insurance coverage.

Rideshare Insurance For Drivers: Where To Buy It, What It Covers Can Be Fun For Anyone

Due to the fact that of this, it's vital that these chauffeurs purchase rideshare insurance coverage, either as extra defense, an individual insurance policy coverage extension or a hybrid insurance bundle. Not all insurance providers problem rideshare insurance coverage, and not all rideshare plans are developed equivalent.

Stage 2You approved a request and are en route to grab a passenger or meal order. Most ridesharing and also some shipment application companies use insurance coverage. Stage 3You have guests or food in the car. All ridesharing and distribution applications offer coverage, yet the degree of that coverage varies from firm to firm.

Since protection via many TNC's is limited and also consists of high deductibles, rideshare insurance likewise aids close voids in protection during stages where your TNC covers you. The Very Best Rideshare Auto Insurance Options, Rideshare vehicle insurance is a relatively brand-new kind of auto insurance policy protection, and also the offerings from different insurance firms can vary extensively. credit score.

A lot of states. State Ranch rideshare chauffeur protection normally adds concerning 15% to 20% to your current vehicle insurance coverage premium, depending upon the insurance coverages you've chosen, any type of price cuts that might apply as well as various other score factors. Ideal for Least Expensive Rideshare Insurance Coverage: Mercury, Mercury is a superb choice if you're seeking economical rideshare insurance.

Mercury will certainly additionally pay to have your c dealt with, relying on the terms of the policy. 11 states. Just $0. 90 a day, according to Mercury. Best for East Shore Drivers: NJM Insurance Coverage Co.NMJ Insurance Provider is an option worth thinking about if you're a rideshare driver that survives on the east coastline.

Fascination About The Best Rideshare Insurance Options For Drivers (2022)

Lyft motorists are required to have a personal vehicle insurance plan that fulfills minimum state coverage needs. Maintain in mind that particular personal automobile plans might not cover you while you're driving with Lyft. For full coverage whenever you drive, think about acquiring a rideshare insurance plan or a rideshare endorsement - perks.

Nerdwallet also keeps in mind that due to the fact that rideshare insurance is only sold as an extension or as a hybrid plan, you can only purchase it from your existing service provider. If you have a personal automobile insurance coverage policy with Allstate, you can not buy rideshare insurance coverage from Mercury - dui. When determining in between an individual policy extension or a hybrid bundle, you ought to do the following: Let your company understand that you're driving for a rideshare policy.

credit score car affordable car insurance car

credit score car affordable car insurance car

Investopedia considered some leading companies as well as evaluated the benefits and drawbacks of each one. They report that a rideshare policy from GEICO: Covers you whether you're off or on the work, Doesn't restrict your gas mileage, Covers shipment service changes, Is somewhat much more costly than various other strategies, Is not offered in every state.

insured car affordable car insurance insurance insurance affordable

insured car affordable car insurance insurance insurance affordable

cars credit auto insurance vans

cars credit auto insurance vans

A State Ranch rideshare policy: Is offered in the majority of states, Covers shipment service drivers, Does not limit gas mileage, Only covers spaces in service-provided plans, Costs even more than comparable plans from other companies, Due to the fact that State Farm's rideshare plan is designed to cover the space between your personal policy as well as the policy provided by the company you drive for, it's suggested for part-time chauffeurs. affordable auto insurance.

With this info, you're sure to discover outstanding insurance coverage at a reasonable cost. Article source This content is created as well as preserved by a 3rd party, and imported onto this web page to aid users provide their email addresses.

The Definitive Guide for Rideshare Insurance For Uber & Lyft - Mercury Insurance

Rideshare companies do offer some insurance coverage, yet it's just throughout specific times. Essentially, rideshare companies resemble that buddy who doesn't use to help pay for the meal yet lend a hand with the idea. Rideshare companies damage down the times you're working and times you're not right into what are called durations.

Note that Uber and also Lyft do have small differences when it comes to the insurance deductible (the amount you pay before the insurance coverage kicks in). Either way, you still require that extra rideshare plan.

Not every carrier does. If it's not readily available, you might need to get commercial insurance. Next off, request for a quote and also compare prices. Rideshare insurance is a sort of add-on plan, indicating it's not a stand-alone thing you can just purchase anywhere. insurers. It has actually to be included to an existing plan.

What Is Rideshare Insurance coverage? Rideshare insurance coverage gives protection for rideshare drivers in case of a crash or costs related to damages or medical care expenses. A few of these expenses are covered by rideshare business' very own insurance coverage, but others are not. Let's damage it down. The insurance industry separates rideshare insurance policy protection into three periods of time: Duration 1 takes place when you have the app switched on but haven't approved a flight.

affordable car insurance car cheapest auto insurance car

affordable car insurance car cheapest auto insurance car

One example is if you were driving about, awaiting a flight demand on the app, and triggered a minor car accident. In that case, rideshare business would not cover your expenses, and your own individual vehicle plan might refute your claim if they weren't previously conscious that you were driving for pay - automobile.

The smart Trick of Rideshare Insurance Coverage - Get A Tnc Quote - State Farm® That Nobody is Talking About

Still, you'll want to do your research study. Pro Suggestion, Talk to your insurance coverage carrier as well as ask to speak with someone familiar with rideshare insurance coverage that can inform you specifically what your rideshare add-on will certainly cover this will aid you precisely contrast protections and also premium expenses. "One point that has altered is that there are a great deal a lot more options for motorists," says Harry Campbell, Chief Executive Officer of The Rideshare Man and also an occasional rideshare driver himself (cheapest).

If you are stressed that the premium you're priced estimate is expensive, seek at least 2 various other quotes. You can additionally take into consideration reduced coverage restrictions that are still within what you would love to purchase, which can save you money. There can likewise be added costs when purchasing rideshare insurance coverage - cheapest auto insurance.

The insurance deductible is typically $2,500 for the comprehensive as well as accident protection. Uber drivers will require to reveal that they are driving for a rideshare firm and also get rideshare insurance policy on their personal car insurance coverage to cover any mishaps they create during Duration 1. auto insurance. Drivers might likewise intend to get additional insurance coverage throughout Periods 2 and 3, if the $2,500 deductible is too expensive.

If you are a rideshare vehicle driver, it is essential to make certain that you aren't leaving on your own at danger by simply driving with a standard personal automobile plan. Make certain to call your insurance company and also ask concerning your options and also the insurance policy costs associated with rideshare driving before you activate that application.

If you rely upon your personal plan, it will certainly not cover you as well as your guests during specific components of the journey. No matter what type of insurance policy you have, how high your insurance coverage restrictions are, or how often you drive for a rideshare solution. However, it's feasible that the rideshare business you drive for supplies some coverage throughout the trip.

Not known Facts About Best Rideshare Insurance 2022 - The Balance

Before you decide to pass up rideshare insurance, check to see what kind of coverage you have with the rideshare business, if any kind of. Comparing Rideshare Insurance Companies It's crucial to contrast rideshare insurer before you select one. Right here are several of the factors you should consider before buying a policy: Not all rideshare insurer market protection in all 50 states.

Rideshare insurance coverage intends to fill the gap between a vehicle driver's very own personal car insurance coverage as well as the protection offered by the rideshare firm. Rideshare business and also insurance coverage providers have actually concurred on a general standard for rideshare coverage.

Do You Need Rideshare Insurance Coverage? While some rideshare business do not call for motorists to have rideshare insurance coverage, Uber and also Lyft do need all of their chauffeurs to be privately insured.

See Now: When you're a rideshare vehicle driver, protection depends on when the accident occurs: Duration 0 App is off, as well as you're not ridesharing (auto insurance). Your individual insurance policy may cover you if a crash occurs.

Your rideshare business's plan covers any kind of accidents while your travelers are in the automobile. If you end up being a rideshare vehicle driver, make certain to inform your insurance company.

Some Known Details About Car Insurance For Uber & Lyft Drivers - Roadway Auto Insurance

Talk to a representative to even more concerning rideshare protection from AAA Insurance coverage. The availability, certifications, and also quantities of protections, expenses and discounts may vary from state to state and there might be protections as well as discount rates not listed right here. In enhancement, other terms, conditions, and exemptions not defined over might use, and also overall cost savings may differ depending upon the protections purchased. insurance company.

Your insurance coverage from Uber, Lyft or any other rideshare company that offers the coverage is in complete effect. Does rideshare insurance coverage expense even more?

Because of that, it's substantially much less costly than industrial insurance policy. Call your insurance coverage agent to review your insurance policy coverage, whether they use it and to obtain an insurance quote.