It is also crucial to remember that considering that vehicle insurance coverage deductibles are on a per-claim basis so the frequency of your claims will certainly be among the most crucial variables - car insurance. If your policy has a $500 deductible and also you were included in four separate claims of much less than $500, then you would certainly be responsible for 100% of all the repayments and also your insurance policy would certainly have offered no coverage - auto.

One strategy you can take is to take a look at your driving as well as lorry background. If your history suggests that you might require to make even more regular claims, you may intend to think about picking a plan with lower expense expenses. On the other hand, if you have not had a background of crashes you may not require a reduced insurance deductible plan.

Whether you're a new vehicle driver or have lagged the wheel for many years, it can be intimidating to learn insurance coverage terminology like "insurance deductible - vans." Your automobile insurance policy deductible impacts the price of your insurance, so it is very important that you choose one meticulously (insure). The deductible that's right for you depends upon your specific conditions.

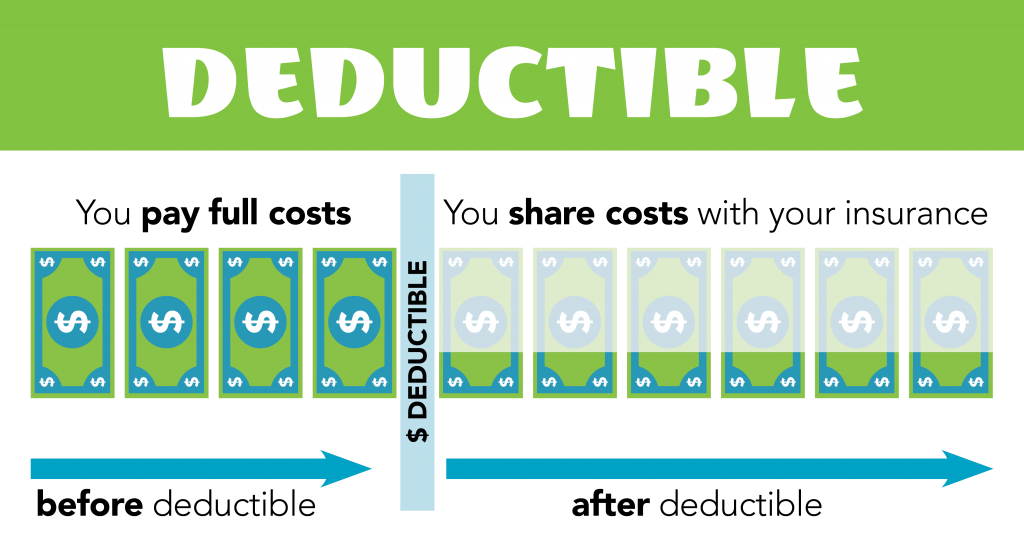

Just how does an insurance deductible job? An insurance deductible is the quantity of cash you pay out of pocket prior to your insurance policy protection kicks in and also begins paying for the costs of your loss.

Not all insurance coverage coverages need a deductible, yet if yours does, you'll select the amount. Your insurance deductible will affect your regular monthly insurance settlement the reduced your insurance deductible, the greater your car insurance premium.

Some Known Facts About Understanding Your Insurance Deductibles - Iii.

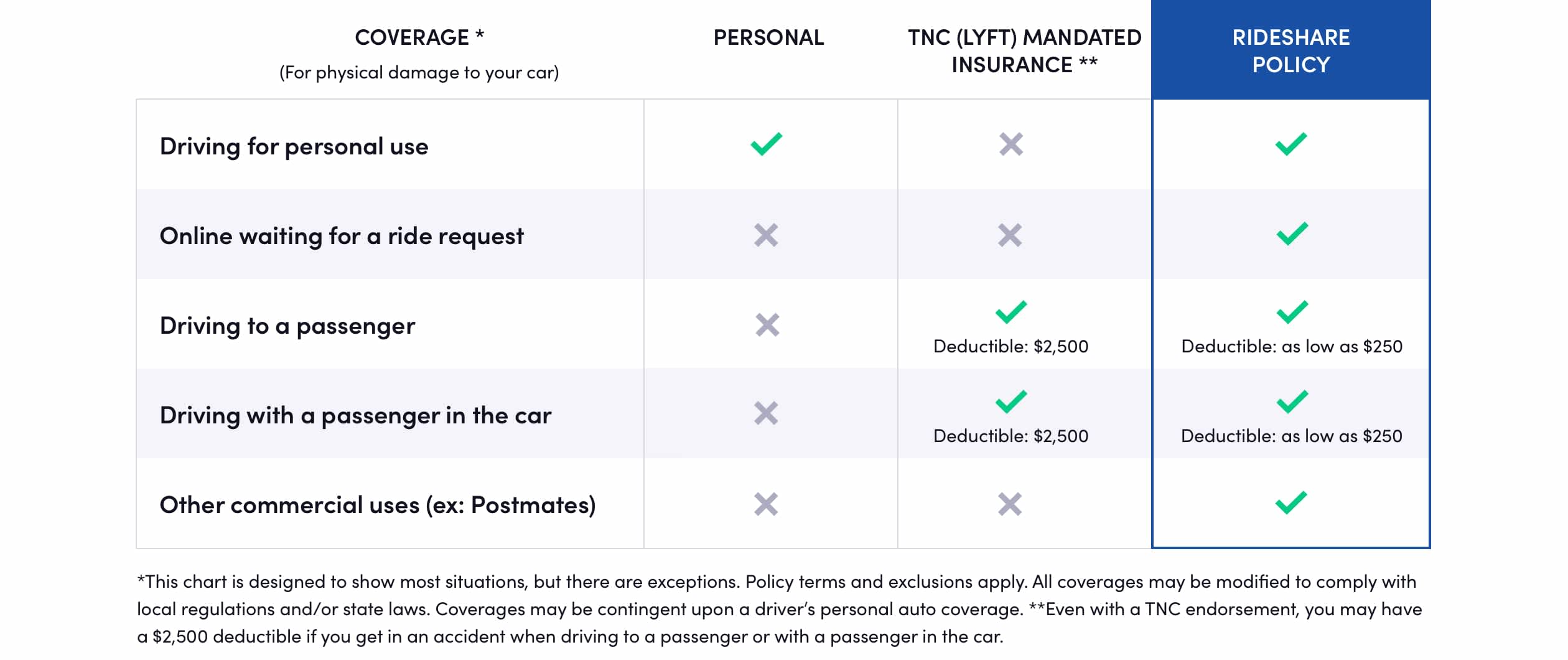

Automobile insurance coverage plans can include various kinds of insurance coverage that serve varying purposes, as well as you can select to be covered by some or every one of them. laws. A few of these insurance coverage choices call for deductibles and also some don't, so it deserves noting what deductibles you'll be needed to pay. State law typically establishes whether or not a deductible is required.

This covers you if your lorry hits one more automobile or things as well as you require to pay for repair work. Accident deductibles are common yet vary by insurance company. If your automobile is harmed by an occasion such as fire, a dropping object hitting your windscreen or vandalism, you'll submit an extensive coverage insurance coverage case - cheap car insurance.

If the other vehicle driver in a crash is at fault but they aren't guaranteed or don't have adequate insurance coverage to spend for your home damages, this sort of coverage will certainly come to the rescue. Deductibles are often needed for this insurance coverage, but not always, and also needs vary by state. While your auto insurance deductible can vary considerably depending upon lots of elements, including how much you intend to pay, cars and truck insurance coverage deductibles commonly range from $100 to $2,500.

When choosing a deductible, you'll need to consider multiple aspects, including your spending plan. low cost. Invest some time computing just how much you can pay for to spend for a deductible and also just how much you'll save money on your monthly premiums by opting for a greater one. Ask on your own these inquiries when selecting a deductible amount.

If you get in a crash, can you afford the insurance deductible or would certainly you battle to pay it? Taking on a high insurance deductible might not make much sense if it stands for a large part of the cars and truck's worth.

Deductibles In Car Insurance: Voluntary And Compulsory - Acko - Truths

Insurance coverage carriers use deductibles to assist minimize their threat involving you, the insured event. What Is a Cars And Truck Insurance Policy Deductible?

Not all auto insurance policy coverage calls for a deductible, but you will frequently locate a insurance deductible is needed for the following sorts of protection, according to Progressive: Comprehensive, Crash, Accident defense, Uninsured/underinsured motorist, The deductible will function the very same method no matter the coverage type and will be required at any time you make an insurance claim - low cost.

You could likewise have to pay your deductible if your windscreen is broken, although some insurance companies do offer full glass coverage as a choice - cars. Are There Times When No Insurance Deductible Is Called for?

Also though you caused the accident, you do not have to pay anything out of pocket when someone makes a case versus your liability insurance for damages you trigger to their home or for injuries. Other situations where you won't be called for to pay an insurance deductible include: An insured vehicle driver hits you.

You choose for cost-free repair work on your glass. Being associated with a mishap with one more guaranteed driver, where the crash is considered their fault, means you won't need to pay an insurance deductible since you'll be making a case with their obligation insurance policy. Nonetheless, you do have the alternative to make a case with your very own crash insurance coverage, if you have it (cheapest).

The 4-Minute Rule for Car Insurance Deductibles: How Do They Work? - The Motley ...

When seeking advice from Allstate, we learnt that, depending on the state you stay in as well as the insurance coverage company you make use of, there is a zero-deductible option available. Obviously, selecting a zero-deductible option on your insurance coverage will likely result in a greater month-to-month costs - car. This is because all the danger is currently assumed by the insurance coverage firm.

The best quantity for you will depend on your financial scenario because your insurance deductible impacts your month-to-month premium rate (risks). Progressive recommends that you maintain this in mind when deciding what total up to establish for your deductible: A higher insurance deductible suggests a reduced regular Discover more here monthly premium, but a greater out-of-pocket cost when making an insurance claim.

Knowing what your automobile insurance deductible is and when you need to pay it is an essential aspect of choosing what kind of insurance protection you want. Make sure you'll have the ability to cover the insurance deductible amount when you make a case to your insurance coverage company to prevent any problems with obtaining repair services looked after in a prompt way.

For any feedback or modification requests please call us at - vehicle. Sources: This content is developed and preserved by a 3rd party, as well as imported onto this page to assist customers give their e-mail addresses (cheaper auto insurance). You might be able to find more information concerning this as well as similar web content at (affordable).